34+ how old to get a reverse mortgage

Search Now On AllinsightsNet. If you think an HECM will fit your needs you can use HUDs lender lookup tool to find a reverse mortgage lender in your area.

:max_bytes(150000):strip_icc()/GettyImages-1306153838-0fae25ddbc7c4ab6ad42c710a78aabad.jpg)

Reverse Mortgage Age Requirements

Comparisons Trusted by 45000000.

. The amount youre able to. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. To become an eligible HECM Home Equity Conversion Mortgage borrower your age should be the age at least 62.

A reverse mortgage can help you pay off debt and live more securely in retirement. Web Rule 1. Looking For Reverse Mortgage.

Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. Web A reverse mortgage is a home loan that allows homeowners ages 62 and older to withdraw home equity and convert it into cash. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

If you are 62 years old or older however you may have another powerful option known as a reverse mortgage at your disposal. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Further you are never too old for a.

Highest Satisfaction for Mortgage Origination. Reverse mortgages are often advertised as a great way for cash-strapped older homeowners and retired persons to. Before taking out a reverse mortgage make sure you understand this type of loan.

Web A reverse mortgage can be an expensive way to borrow. Because of this the reverse mortgage age requirement is 62 or. On a reverse mortgage line of credit the 62-year-old borrower could be eligible to receive up to 107000 compared to 123000 for the 72-year-old.

Web A reverse mortgage is a loan taken out against the value of your home. No personal information is required to calculate. A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes.

Ad Best Pre Approval Mortgage In Kansas. If you are 62 years old or older and have considerable home equity you can borrow. Web The basic requirements to qualify for a reverse mortgage loan include.

Certain criteria must be met to qualify for a reverse mortgage including owning your own home and having enough equity. Apply Online To Enjoy A Service. Web Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

Borrowers dont have to pay taxes. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Ad While there are numerous benefits to the product there are some drawbacks.

If you apply with. Assuming the same home value of 200000 and no mortgage balance you could receive monthly payments of up to 660. Web Now lets say you wait to get a reverse mortgage until age 72.

Web Age Requirements. Web How to Get a Reverse Mortgage. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Web Alternatives to a reverse mortgage. Web With a reverse mortgage your loan balance grows over time and the younger you are the more time that balance has to grow. Ad 2023s Trusted Reverse Mortgage Reviews.

It lets you convert a portion of your homes equity into cash. Compare Best Lenders Apply Easily Save. Reverse mortgages were meant to help seniors in or nearing retirement.

Web Reverse Mortgage Minimum Age Requirement. You must be at least 62 years old to get a reverse mortgage. You must meet the age requirement.

Web A reverse mortgage is a type of loan for homeowners aged 62 and older. The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Theres no way around this one. You may want to look at other borrowing and. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web Our reverse mortgage calculator can help you determine how much money you might qualify to receive in a lump-sum payment. Web When it comes to obtaining a mortgage loan most homeowners tend to think in terms of whats known as forward mortgages such as conventional FHA VA and USDA loans.

The youngest borrower on title must be at least 62 years old live in the home as their primary. Ad Should You Get A Reverse Mortgage On Your Property.

Is A Reverse Mortgage Beneficial Reverse Mortgage California

Can You Get A Reverse Mortgage At Age 55

Reverse Mortgage Stock Photos Pictures Royalty Free Images Istock

Reverse Mortgage Calculator Reverse Mortgage

Most Reverse Mortgages Terminated Within 6 Years According To Hud

How Does Reverse Mortgage Age Limit Affect Your Eligibility

How Does Reverse Mortgage Age Limit Affect Your Eligibility

Glenn E Grant Mortgage Loan Officer Maxwell Mortgage Team Linkedin

April 2020 By The Active Age Issuu

:max_bytes(150000):strip_icc()/GettyImages-1193367476-2222f52da6d247f7a43eafeba1da7b12.jpg)

How Age Affects Your Reverse Mortgage Payout

Reverse Mortgage Funding Lowers Age Requirement To 55 For Its Proprietary Reverse Mortgage Product Equity Elite R

Can You Be Too Old For A Reverse Mortgage

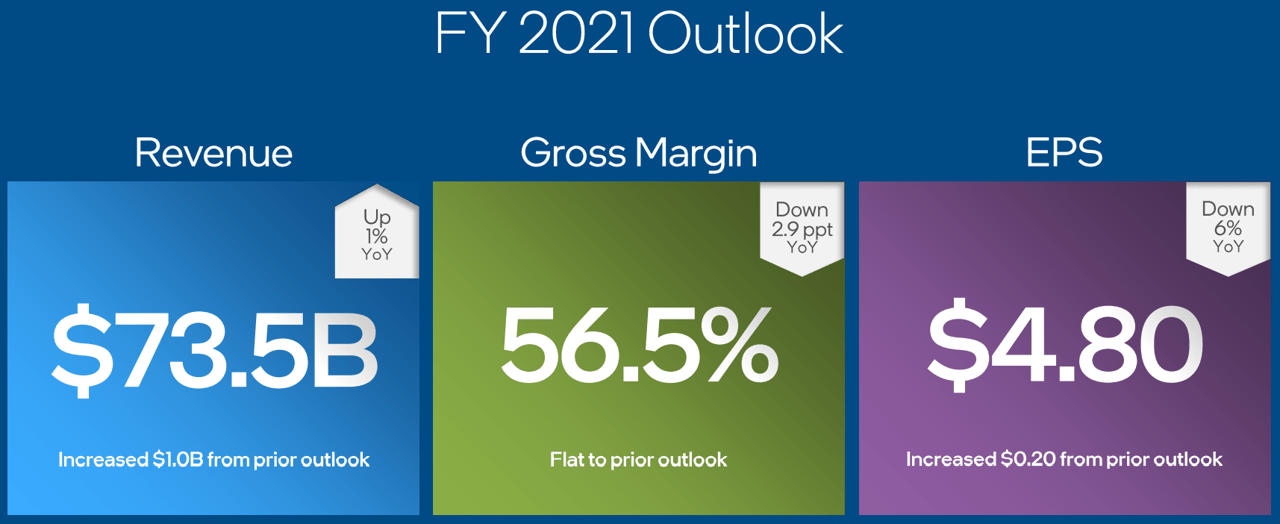

Intel Is Ugly Q2 2021 Earnings 3 Better Chip Stocks To Own Nasdaq Intc Seeking Alpha

Are You Ever Too Old For A Reverse Mortgage

Can Anyone Take Out A Reverse Mortgage Loan Consumer Financial Protection Bureau

Discover The Latest Age Requirements For Reverse Mortgages In 2023

34 Types Of Startup Metrics To Measure With Examples Startupdevkit